Despite seeing positive annual growth the month before, Malaysia witnessed a sharp decline in online hiring for March 2020.

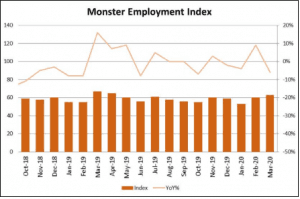

According to Monster Employment Index (MEI), the beginning of the year started off rocky or e-recruitment in Malaysia, as January brought a decline of 4% year-on-year. In February, though, online recruitment in Malaysia saw a significant spike, with a 9% year-on-year increase. However, this was followed by another dip in March which saw a 6% year-on-year decline.

“The COVID-19 pandemic is affecting the world in an unprecedented way. On 18 March, Malaysia implemented a national Movement Control Order (MCO) as a measure to curb the spread of the virus. This partial lockdown has severely impacted many businesses and companies in Malaysia, and online hiring has also taken a hit. We are cautiously optimistic that there will be a gradual U-shaped economic recovery for the region, and hope we will see an improvement in online recruitment once the MCO is lifted,” said Krish Seshadri, CEO of Monster.com – APAC and Middle East.

The Monster Employment Index (MEI) is a gauge of online job posting activity compiled monthly by Monster.com. It records the industries and occupations that show the highest and lowest growth in local recruitment activity.

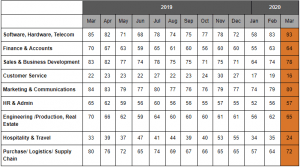

In March 2020, only two of the nine industry sectors monitored by the Index, witnessed growth in online recruitment activity.

Malaysia’s Oil and Gas sector witnessed the biggest growth, registering a 6% year-on-year increase in online recruitment activity in the month of March. This is the most notable hike in e-recruitment activity for the Oil and Gas industry since October 2019. The growth momentum improved by nine percentage points – up from a decline of 3%in February 2020. In the short-term, the sector has fared well, up 5% (month-on-month), up 4% (three-month) and up 3% (six-month).

The IT, Telecom/ISP and BPO/ITES industry continues to reign as the most popular industry in e-recruitment in Malaysia. For the month of March, there was a 3% year-on-year increase in demand for hiring, but on-the-month, the sector saw no growth (zero percent).

E-recruitment activity in Advertising, Market Research, Public Relations, Media and Entertainment saw marginal decline of 2% on-the-year, down from 19% growth last month. Nonetheless, on a six-month basis, the sector exhibited the steepest growth (up 13%) among all sectors.

Year-on-year, the Hospitality industry receded in annual growth for the first time since April 2019, with a decrease of 3%. Month-on-month, the sector saw a decline of 8%.

Meanwhile, the Logistic, Courier/Freight/Transportation, Shipping/Marine sector recorded the most notable decline among industry sectors in March 2020, with a 18% year-on-year decline.

In terms of specific job roles, the year-on-year growth for professionals was positive in only one of the nine job-roles monitored by the Index. Software, Hardware, Telecom professionals were the only occupation group to record positive growth among job-roles, with a 9% year-on-year growth in March. In short-term, the sector witnessed strong double-digit growth across the board; up 12% (month-on-month), up 29% (three-month) and up 24% (six-month).

Marketing & Communications professionals witnessed a 5% decline on an annual basis in March and long-term growth momentum for this occupation group eased by 10% between February and March 2020. However, monthly demand recorded a small growth of 1% in March.

Year-on-year, Sales & Business Development professionals recorded a decline of 6%. Nevertheless, online demand remained positive on all other parameters; up 5% (month-on-month), up 10% (three-month) and up 4% (six-month).

Meanwhile, Customer Service and Hospitality & Travel (both down 27% year-on-year) recorded the steepest annual decline in March 2020 among job-roles.

The Monster Employment Index is a monthly gauge of online job posting activity, based on a real-time review of millions of employer job opportunities culled from a large representative selection of career websites and online job listings across Malaysia. The Index does not reflect the trend of any one advertiser or source but is an aggregate measure of the change in job listings across the industry.

By Industry

By Occupation