Ten of the fourteen Asia-Pacific housing markets included in this global survey showed stronger momentum in 2020 compared to a year earlier. House prices rose in eleven countries, with notable increases in New Zealand in Sri Lanka.

Subscribe to our Telegram channel to get a daily dose of business and lifestyle news from NHA – News Hub Asia!

Global Property Guide released its new research study, Global Residential Markets Report. Based on this global survey, Global Property Guide uncovered the following:

- It’s a great time to own real estate. Owners are getting richer, as home prices rise by leaps and bounds in many countries in Europe, Asia-Pacific, and the U.S. and Canada.

- Real house and apartment prices (i.e., prices adjusted for inflation) rose in 2020 in 40 out of the 53 world’s housing markets which have so far published housing statistics. The more upbeat nominal figures, more familiar to the public, showed house price rises in 45 countries, and declines in only 8 countries.

- The North American housing market is booming. The U.S. FHFA house price index rose by 9.42% in 2020 (inflation-adjusted), the biggest y-o-y increase ever recorded, buoyed by very low interest rates and massive government stimulus spending.

- Likewise in Canada, home prices in the country’s eleven major cities rose by 8.57% during 2020, in contrast to a fall of 0.29% the previous year.

- Demand has been boosted by record low interest rates, as well as quantitative easing. New demand is also coming from more properties being bought outside cities.

- Strong home price surges have taken place in European countries, such as Slovak Republic (+14.28%), Turkey (+13.7%), Germany (+11.42%), Estonia (+10.37%), Sweden (+9.79%), and Russia (+9.14%), using inflation-adjusted figures.

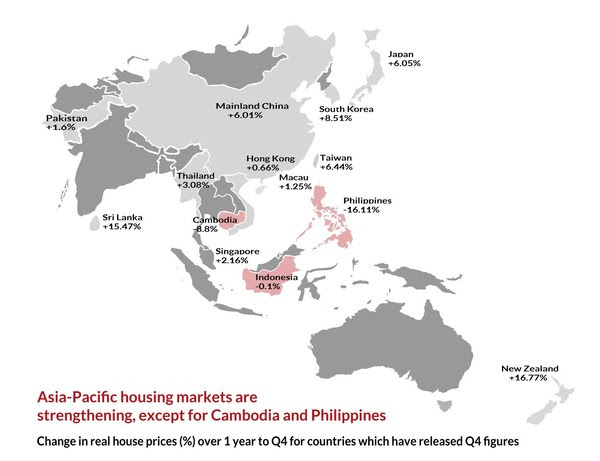

- Asia-Pacific is gaining momentum, with notable performances from New Zealand (+16.77%), Sri Lanka (+15.47%), South Korea (+8.51%), Taiwan (6.44%), Japan (6.05%) and China (6.01%).