Cross-Jurisdictional Adoption of ESG & SDGs: The Role of IFCs via Digitalisation

Labuan International Business and Financial Centre (Labuan IBFC) have launched a research paper on ‘International Financial Centres: Facilitating Financial Inclusion via Digitalisation’, jointly produced with UK based Z/Yen Group today.

Subscribe to our Telegram channel to get a daily dose of business and lifestyle news from NHA – News Hub Asia!

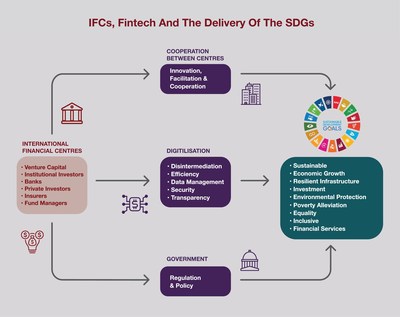

The research paper explores the ‘recalibrated’ role International Financial Centres (IFCs) play in response to the global calls to enhance the collective aims of financial inclusion and Sustainable Development Goals (SDGs). As jurisdictionally agnostic financial centres intermediating the global business and financial system, IFCs have an integral role in ensuring end to end SDGs and environmental, social, and governance (ESG) adoption.

The paper highlights the essential co-operation and partnership needed among policymakers, financial centre leaders, regulators and financial service providers; financial centres can create the bridges for collaborative action, provide crucibles for innovation, and show leadership on regulation, standards, and benchmarking.

“IFCs as wholesale financial intermediation centres have always had a crucial role to play in the global financial ‘plumbing‘, and as such have been the key enabler of globalisation and economic growth. It only stands to reason that IFCs, have now to embrace their role in the curation of an inclusive financial system to support the SDGs. However, we cannot act in isolation, as such partnership amongst centres is key in achieving this collective aim,” said Farah Jaafar, CEO of Labuan IBFC Inc, the market development arm of the jurisdiction.

The research paper further highlights financial inclusion being the fulcrum of equality and key to the delivery of the SDGs, and in particular how IFCs can facilitate financial inclusion by using new and emerging technologies in the digitalisation of financial services.

“A frequent criticism of international financial centres is that they are divorced from the ‘real economy’. While there is some truth in the criticism, IFCs are crucial to trade, investment, and skills development. Labuan IBFC’s call to fellow centres to aid digitalisation is most welcome. Digitalisation is a major step on the road to connecting better the real economic concerns implicit in SDGs with real finance,” said Professor Michael Mainelli, Executive Chairman, Z/Yen Group.

Digital advancement reduces the cost of business generally as well as offers efficiency and transparency via distributed ledger technology (DLT) – thereby providing a clear and indisputable ‘audit trail’ in the roll out of SDG related initiatives. The research also notes the importance of DLT for the tracking and tracing of supply chains and monetary transaction chains.

With the effects of COVID-19, it is imperative that international key stakeholders band together and work towards achieving the global aspirations of the SDGs to ensure its success.

Ms Jaafar added, “Labuan IBFC embraces this leadership obligation and calls on other IFCs to work with it to pursue this aim, providing holistic financial tenants in inclusion and equity that transcends borders. The adoption of technology via digitalisation will be the key enabler, from a transparency, operational and cost efficiency viewpoint.”

Labuan IBFC being a wholesale innovative intermediation centre, provides various technology enabled structures via the concept of a ‘digital wrapper’ with a dedicated focus on encouraging financial inclusion through its DLT or digital structures and licences.

A ‘digital wrapper’ or a digital business plan fundamentally acknowledges that the element of technology to be utilised is embedded into the business plan of each proposed licensed entity, and the regulator will then assess each applicant based on merit.

SOURCE Labuan IBFC (press release)