- VSure.life is Malaysia’s first On-Demand Lifestyle Digital Insurer approved by Central Bank of Malaysia (“Bank Negara Malaysia”) under its Financial Technology Regulatory Sandbox Framework

- Features pay-per-use coverage plans to deliver flexible and affordable on-demand protection on VSure.life mobile app

- Have successfully attracted investment of RM12 million with key investor Revenue Group Berhad (“REVENUE”)

Subscribe to our Telegram channel to get a daily dose of business and lifestyle news from NHA – News Hub Asia!

Malaysia-based VSure.life (“VSure” or “Company”) is the country’s first insurtech company to have secured approval from Bank Negara Malaysia to introduce on-demand insurance and protection plans for the masses, serving as a compelling vision that will make digital insurance even more accessible and affordable for everyone and playing a role in contributing to elevate Malaysia’s digital agenda.

Bank Negara Malaysia who plays a critical role in shaping Malaysia’s economic growth and development, has strong aspirations to promote and cultivate the growth of fintech in Malaysia. With insurtech being a vital segment in fintech, it is key to bringing positive socioeconomic impact to the nation. The approval from Bank Negara Malaysia Financial Technology Regulatory Sandbox Framework indicates VSure’s readiness to be commercially tested as a fully On-Demand Lifestyle Digital Insurer model in the Malaysian market, with the objective to push the insurtech industry forward to make digital-first protection a norm for Malaysians.

In the initial stage, VSure as Malaysia’s first on-demand lifestyle digital insurer will be rolling out a series of ultra-affordable and flexible lifestyle protection plans, which reflects its commitment making protection truly accessible, contributing to a future where protection can be inclusive and a second nature for all.

To realise this vision, VSure will introduce the pay-per-use feature for its underwritten protection plans that gives consumers the options to select coverage by duration or amount. Users opting for coverage by duration will have the freedom to purchase protection as low as by the hour, to account for key moments that requires protection for an extra peace of mind.

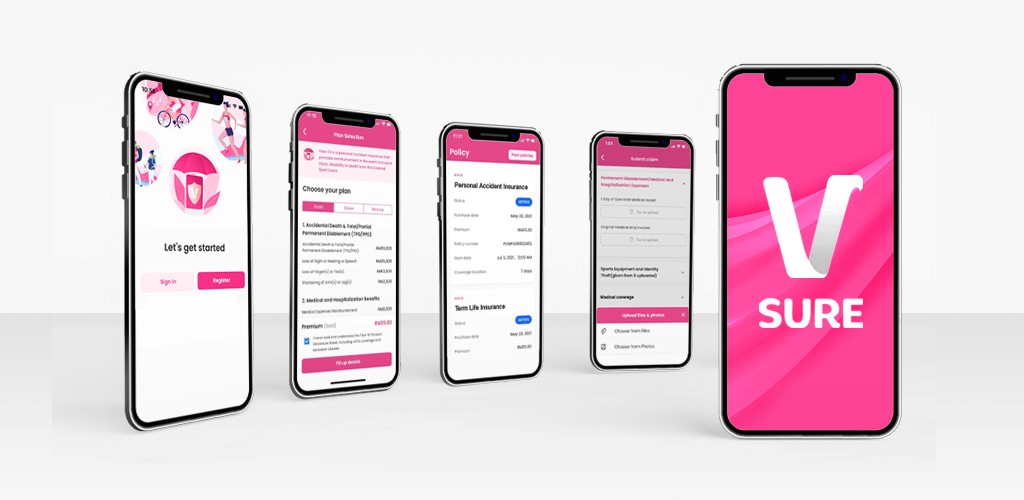

Embracing the norm of digital-first and going paperless, VSure’s protection plans are available exclusively on digital platforms via its website (www.vsure.life) or the VSure mobile app (available on both Apple App Store and Google Play Store). The entire end to end protection process, from purchasing to claims, is designed to ensure a seamless, easy to understand, and stress-free journey that accommodates the unique and dynamic modern lifestyles of Malaysians.

“We are extremely honored to be given the opportunity to drive the digital insurance revolution in Malaysia. It is a vision that we have been relentlessly working towards for the past four years, and we thank both Bank Negara Malaysia and our investors, REVENUE, for sharing our excitement for the future that lies ahead,” commented Eddy Wong, Co-Founder, Chief Executive Officer & Managing Director of VSure.life. “The growing demand for digitalised insurance services is set to propel the size of global insurtech market worth to an estimate of USD11.94 billion by 2027. We are excited to catalyze Malaysia’s insurtech industry and we foresee that an obtainable market size of RM 300 million can be achieved within the next two to three years, as a reflection of our faith in the potential of insurtech in Malaysia.”

Over the coming months, VSure will be introducing a series of its own underwritten on-demand protection solutions with new to market pay-per-use feature. The company is also in partnership with locally licensed insurers to feature Life, Health & Medical, Home, Personal Accident, Travel, Motor and Takaful coverage plans, readily available on VSure’s platforms today. VSure has also signed strategic and commercial partnerships with a few digital banking license applicants to develop customised and specialised protection coverage plans within the digital banking ecosystem.

In addition to obtaining approval from Bank Negara Malaysia under its Financial Technology Regulatory Sandbox Framework, ACE Market-listed REVENUE (銀豐集團) had also announced today to invest RM12 million into VSure through its wholly owned subsidiary company, Revenue Harvest Sdn Bhd, serving as a sign of confidence in the disruptive potential of VSure to drive real change and bring a positive socioeconomic impact for Malaysia. The partnership between VSure and REVENUE enables the company to access REVENUE’s B2B2C payment ecosystem and solutions to further strengthen VSure’s offerings to mass Malaysians.

“We are delighted to have found the right partnership in VSure and joining forces together to provide innovative products and services to our customers. VSure’s capabilities and impressive vision to reinvent insurance policies with highly customisable products and greater flexibility are aligned to the core values at REVENUE,” said Datuk Eddie Ng Chee Siong (黄志雄), Managing Director and Group Chief Executive Officer of REVENUE. “We look forward to further build upon our excellent partnership and truly make a difference in entire region of Southeast Asia.”

Source: VSure.life (Press release)