According to Omdia, Covid-19 driven cloud services consumption sets server shipment record for 2Q 2020.

The global server market recorded the strongest second quarter on record in terms of shipments. A total of 3.4 million servers shipped in the second quarter of 2020, up 39 percent year-over-year. According to Omdia’s latest Data Center Server Equipment Market Tracker.

The increase in server shipments is a result of an increased reliance on cloud services for both consumers and enterprises. Consumers are continuing to rely on cloud services for entertainment, social interaction, and learning while in lockdown.

Enterprises also continued their increased reliance on cloud services as many continue to keep their offices closed due to the global pandemic, resulting in increased demand for services such as virtual desktop infrastructure (VDI) in aid of remote working.

Manoj Sukumaran, senior analyst for data center compute, at Omdia, commented: “In the second quarter there was a strong demand for servers from Tier 2 cloud service providers (CSPs) and Communication Service Providers (Comm SPs).

“For many enterprises, migrating to cloud services was a cost saving measure used to offset lower revenues due to Covid-19, avoiding data center IT capital expenditures (CapEx). The increasing consumption of streaming media services like Netflix, YouTube, Hulu etc. and the use of higher quality media content has created a need for expanding content delivery networks driving server demand from Comm SPs.”

Omdia’s Data Center Server Equipment Market Tracker also found an increase of the average selling prices (ASPs) of servers and attributed it to two factors. First, a larger number of servers were shipped to Tier 2 CSPs and Comm SPs which carry a higher ASP, and the volume low-cost servers shipped to hyperscale cloud service provider decreased. Second, there was an increase in the price of components, including memory and flash storage. As a result, server revenue followed unit growth and was up 18 percent year-over-year.

The 2020 outlook

Omdia has updated its server revenue forecast, baking in the increased demand for servers driven by cloud services and tightening of enterprise spending due to the global COVID-19 pandemic. Omdia now projects an 8 percent increase of server revenue in 2020–an upward revision of 8 percentage points from the previous forecast. The forecast update increased the server market’s value to $85 billion for 2020.

“There were mainly two factors driving the update, one is the sustaining demand for cloud services and the second one is the new CPU refresh cycle,” Sukumaran said. “Facebook would be deploying Yosemite v3 servers based on the latest Intel Cooper Lake CPU, which will likely have a larger number of cores and will be more costly than the Xeon D.”

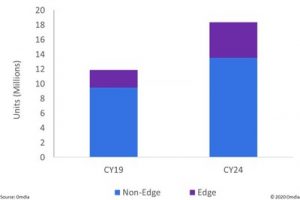

Omdia expects 13.2 million servers to ship in 2020, an 11.5 percent growth over 2019. This number is expected to top 18 million by 2024, with server shipments growing at an 9 percent compound annual growth rate. Over 5 million or 26% of all servers shipped in CY24 will be located at the edge, up from 2 million (20%) in CY19.

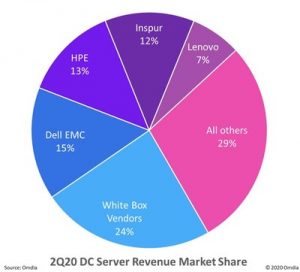

In the second quarter of 2020, White Box Vendors, including Wiwynn, QCT (Quanta), Tyan (MiTAC), and Ingrasys (Foxconn) took 24% share of server revenue as the demand from CSPs remained strong. Dell EMC had 15% share followed by HPE at 13%. Inspur had a strong quarter and increased its share to 12% in 2Q20, a 4% points gain over the previous quarter as reported by Omdia’s Data Center Server Equipment Market Tracker. Lenovo rounded out the top five with 7% share.

SOURCE Omdia