Spending money internationally can be stressful. Whether you get a headache when calculating conversion rates during a European shopping spree or are unsure what to do when a restaurant does not accept your bank card, we have all found ourselves in situations where we have faced spending woes abroad.

Luckily, there are smart and easy ways to spend money internationally, so here are a few ways that can turn your ‘spending woes’ into ‘spending woos’!

Get the lowest rates when purchasing viral products

Platforms like TikTok and Instagram have been powerful tools in convincing many Malaysians to try out the latest fashion, beauty, and food trends.

However, not every item or product that goes viral on TikTok can be easily purchased online — if you’ve ever tried buying something from websites like Amazon, Revolve or Gymshark, you know that when you try to check out, the total amount charged to your credit card isn’t in your country’s currency.

There is a wiser solution to satisfy your FOMO: the Wise app! Wise offers a Visa card that works exactly like your debit card – all you have to do is top up your account through the app and then get to shopping. Wise uses the fair, mid-market exchange rate to convert your money, and the app ensures full transparency with any purchase so you don’t have to worry about exchange rate mark-ups or foreign transaction fees when checking out your cart.

Keep your money safe so you never miss an enchanted experience

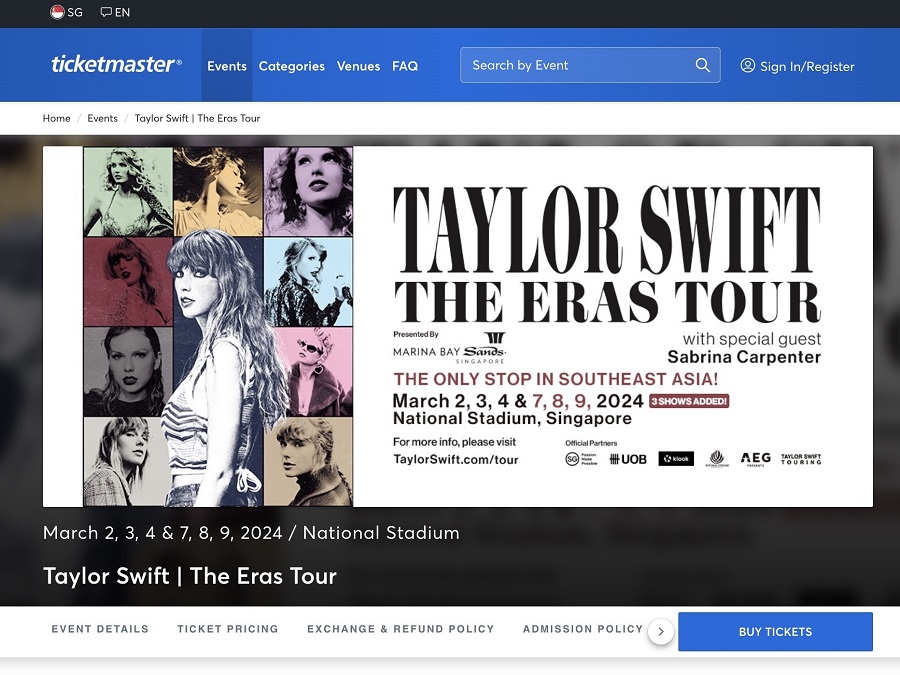

Concert season is currently in full swing, and if you’re feeling a little blue because you couldn’t score a ticket for the stop in your city, why not make a holiday of it and go see your favourite band overseas?

That said, it’s normal to worry about using an unfamiliar ticketing platform and purchasing tickets in a foreign currency. There could be unexpected additional charges, and what about potential security risks?

The Wise card can be your ticket to the concert of a lifetime! Wise is regulated under Malaysian financial banking laws by BNM and has a dedicated team working around the clock to keep your account and money safe.

Wise also has added features that keep your money safe. If you ever feel that your Wise card has been compromised from an online purchase, you can easily freeze and unfreeze your card in the Wise app for added protection.

Stay secure, go virtual

You might feel that adding yet another card to your wallet just for international expenses will be a hassle. But rather than receiving a physical card, you can opt for a digital card. With Wise you can have up to three digital cards, and each one can have different details.

The concept is simple: the digital cards exist on your phone and can be frozen or deleted anytime so you can generate new card details if needed. The virtual card number is different from your physical Wise card, which provides an additional layer of security when you are spending on unfamiliar websites.

So after you have ordered your physical card, you can immediately get your digital cards through the Wise app for any online bookings or purchases.

Going on vacation? Track every impulsive vacation purchase

If you have ever been on vacation and thought to yourself, ‘I’m on vacation, budgeting doesn’t matter!’ but then end up dealing with buyer’s remorse when you get back home– you might want to consider taking your budgeting seriously.

While the good ol’ spreadsheet might work, why not try a daily budget-tracking app like Wallet by budgetbakers? With this app, you can easily see how much you have spent in a day and it just might prevent you from giving in to every impulsive purchase so you do not go over your budget.

International spending sprees

We all know that travel and spending are synonymous. But if you are used to just scanning a quick QR code to make a purchase, you may find yourself stumped on your travels.

Not every country will have QR codes or offer easy bank transfers, so you may have to whip out a good ol’ card. If you do not have a credit card or just simply do not want to deal with any fees, an international banking card is your best bet.

The Wise Visa card can be used like any other card – the difference is that it offers the lowest rates, full transparency, and a seamless experience when spending internationally. Just make sure to top up your account through the app prior to your grand shopping spree, and then spend away!

Happy Spending!

Source: Wise