Jumio, the leader in AI-powered identity intelligence anchored in biometric authentication, automation and data-driven insights, today released new findings from its 2025 Online Identity Study.

As consumers worldwide set out for summer leisure, digital identity protection may be taking a more prominent spot on the packing checklist.

Nearly half of global consumers (44 per cent) lack confidence in the travel industry’s ability to protect them from AI-powered fraud, including identity theft and account takeover fraud. Interestingly, while that figure rises to 55 per cent in the United States, Singapore reported the lowest level of concern globally — only 37 per cent of consumers say they lack confidence in the industry’s fraud protections. This raises concerns that consumers in one of Asia’s busiest travel hubs may be underestimating the growing threat of AI-driven scams.

For the sharing economy (including holiday rentals and other travel-focused gig economy services), confidence falls even further, with 42 per cent in Singapore and 50 per cent globally saying they don’t feel adequately protected.

Consumers share sensitive personal data in exchange for a simple holiday, notably turning over government-issued IDs like passports and drivers’ licenses in order to book and check into flights, reserve accommodations and rental cars, and more. This exchange of data makes consumers vulnerable to fraud during the summer travel season — and they recognise the risk.

These sentiments trend alongside broader global distrust in digital spaces, with 69 per cent of global respondents (and 74 per cent in Singapore) saying AI-powered fraud now poses a greater threat to personal security than traditional forms of identity theft.

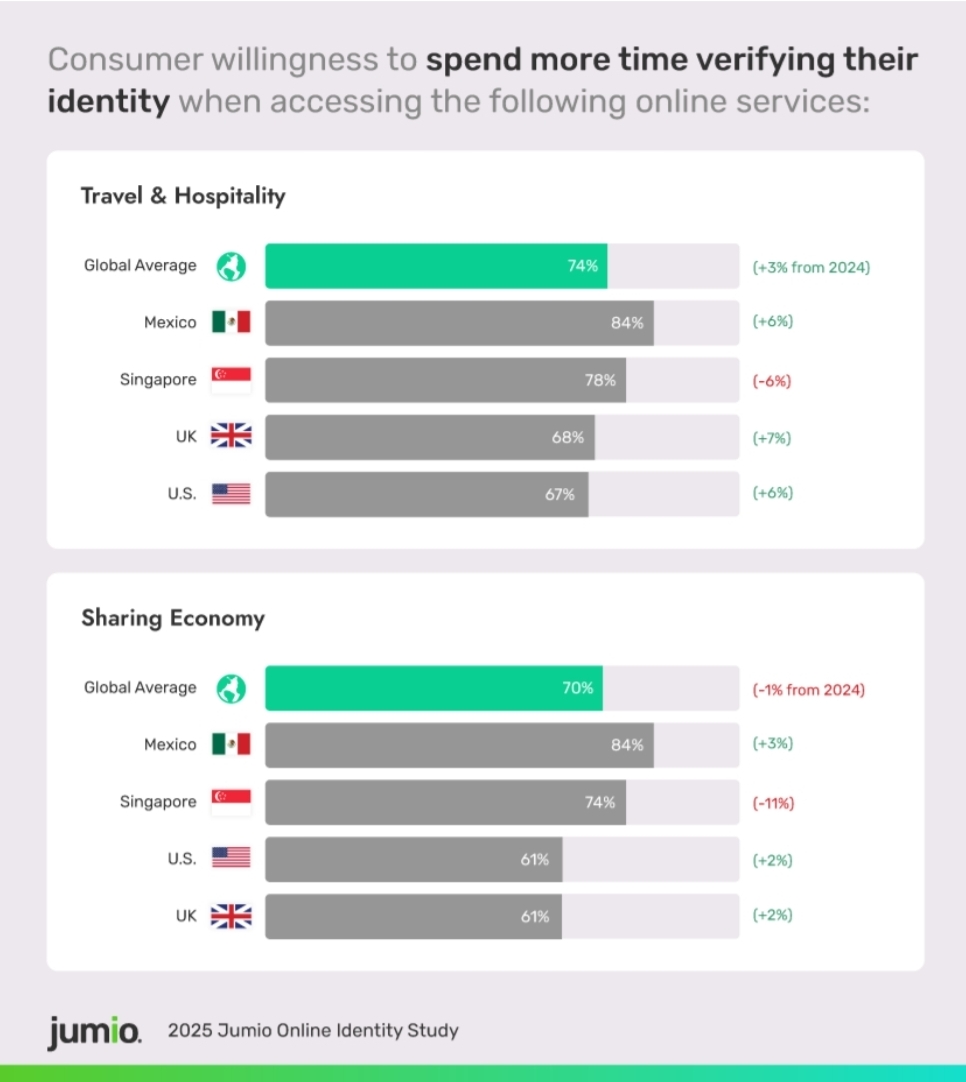

In response to this distrust, consumers worldwide are slightly more willing to invest more time in identity verification on these platforms than in 2024. However, some markets — like Singapore — are showing signs of decreasing caution, potentially prioritising convenience over security:

• In 2025, 74 per cent of global consumers said they would willingly spend more time on identity verification when accessing travel and hospitality-related platforms if it improved their security — up from 71 per cent in 2024. In Singapore, the figure is even higher at 78 per cent, but this actually represents a six per cent decline from last year, signalling a possible shift toward convenience despite rising AI fraud risks.

• Global willingness to spend time verifying identity on sharing economy platforms also stayed high at 70 per cent in 2025, only slightly down from 71 per cent in 2024. In Singapore, however, the drop was steeper — falling 11 percentage points to 74 per cent, down from 85 per cent in 2024. This suggests that, despite increasing fraud sophistication, Singaporean consumers may be letting their guard down when it comes to personal security on these platforms.

Global consumers’ increasing willingness to spend time on identity verification for travel-related transactions follows a growing trend in traditionally higher-risk industries. For instance, 80 per cent of consumers globally and 82 per cent of Singapore consumers were willing to spend more time on security for digital platforms supporting banking and financial services.

“Whether it’s an evacuation plan or a safe in every hotel room, the travel and hospitality industry know how to build the structures and processes customers need to feel safe. Now customers expect the same level of care for their personal data,” explained Bala Kumar, chief product and technology officer at Jumio. “But travel and hospitality businesses can’t keep layering traditional protections on already complex processes — they need new solutions and technologies to balance convenience with protection, even as AI-powered scams evolve.”

Find additional data and insights here.

The Jumio 2025 Online Identity Study surveyed 8,001 adult consumers evenly distributed across the United States, the United Kingdom, Singapore, and Mexico. Censuswide fielded the survey between 9 and 24 April 2025. Censuswide abides by and employs members of the Market Research Society which is based on the ESOMAR principles and are members of The British Polling Council.

Source: Jumio (Press Release)