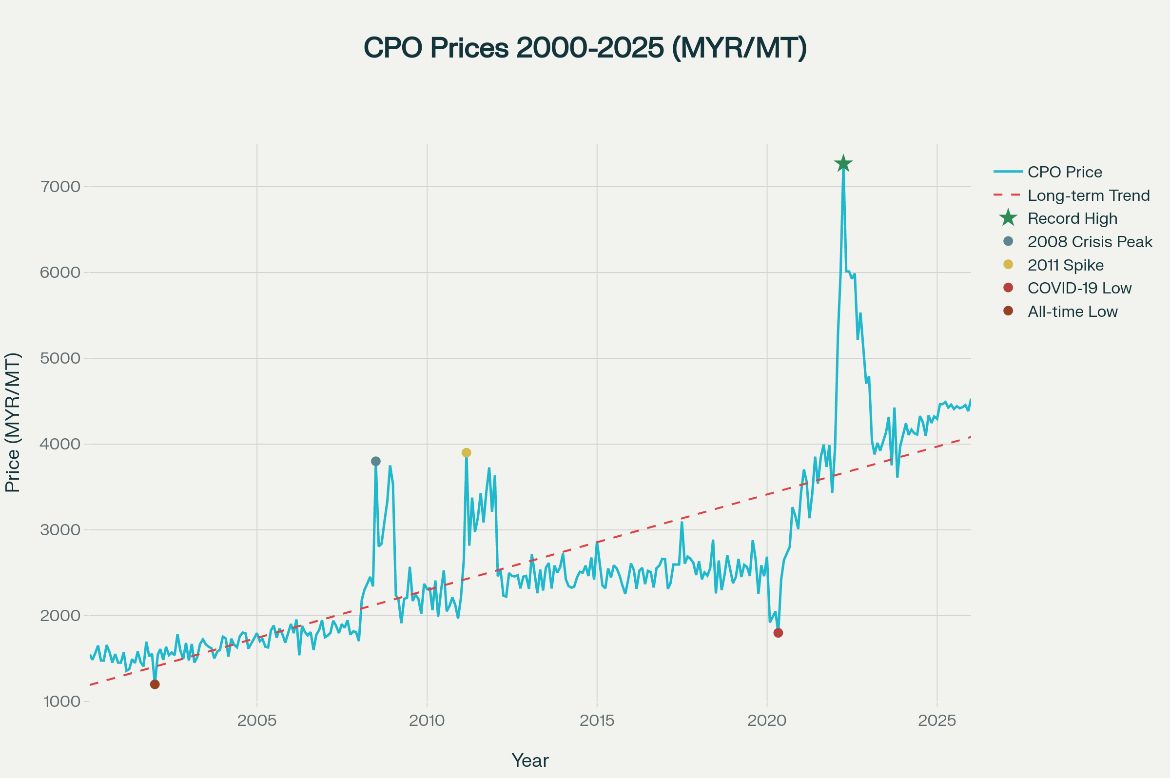

Over the last 25 years, crude palm oil (CPO) prices have shown strong resilience and growth, even as markets endured multiple food crises and global shocks. The compound annual growth rate (CAGR) for CPO is 2% over the last 10 years, 7% over the last 20 years and 7% over the last 25 years.

From an annual average of about RM1,400/MT in 2000, prices rose to over RM4,425/MT by 2025, with a record peak of RM7,268/MT in March 2022. The upward trajectory, punctuated by price spikes in 2007–08, 2010–11, and 2021–22, closely mirrors global food inflation cycles[4][5].

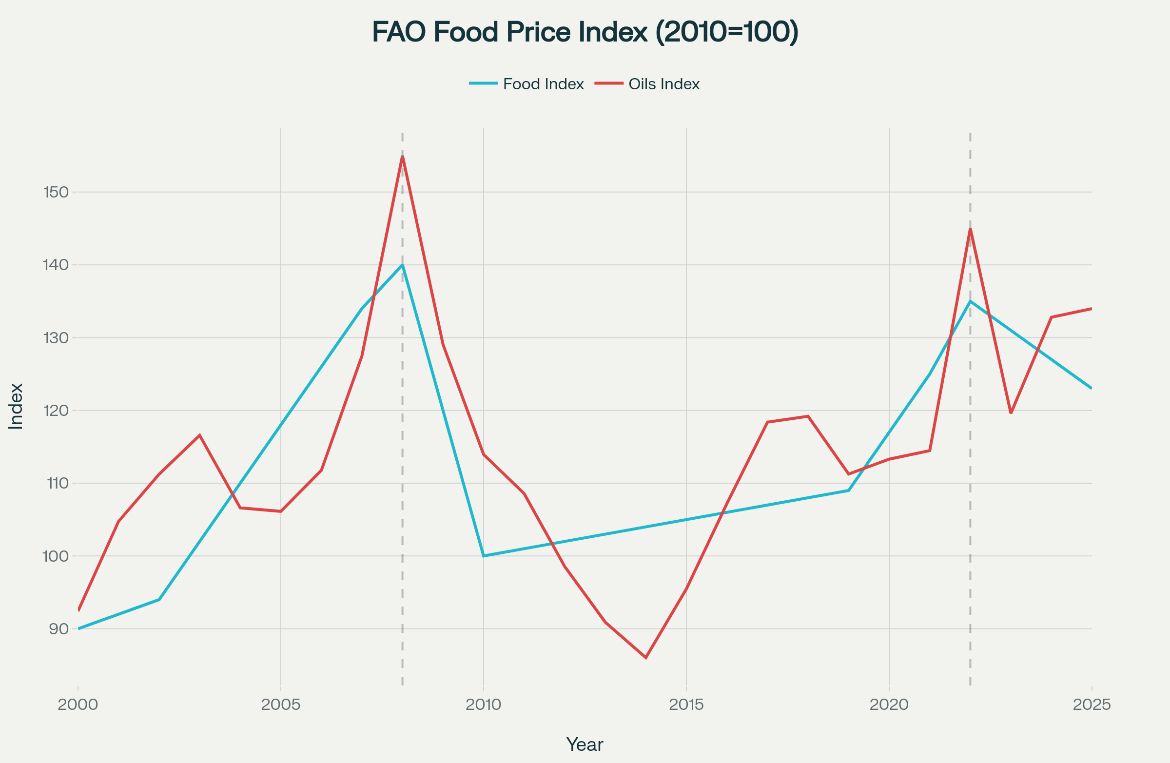

Food and Food Crop Inflation: 2000–2025

The FAO Food Price Index has surged over the last two decades, rising from 90 points in 2000 to 130 points in 2025 (2010 = 100), reflecting persistent food inflation pressures. The Vegetable Oils sub-index often outpaces the overall food index, especially during supply or policy shocks (e.g., the 2022 price surge following the Ukraine conflict and export bans). This pattern shows how edible oils, including palm oil, strongly influence food affordability worldwide.

Population and Demand Growth

The global population will exceed 8.5 billion by 2030, with China and India driving most of the increase in edible oil consumption. Annual palm oil demand in these countries is growing at 2.5–3.5%, fueled by new dietary patterns and urbanisation. With Africa’s population also rapidly rising, future edible oil demand will remain robust.

Production and Climate Challenges

Output growth and productivity per unit area from Malaysia and Indonesia are overly controlled by government-imposed moratorium on greenfield developments, and rising cost of sales.

In addition, another silent and hidden threat is pests & diseases, in particular, Oryctes rhinoceros in replanted areas and Basal Stem Rot or Ganoderma boninense in mature palms are significantly impacting palm productivity. A lack of interest among locals and the industry’s labour-intensive nature negatively impacts production in Malaysia, leading to significant financial losses as estimated by the government and industry associations. Climate change compounds risk, with droughts, erratic rainfall, and fire events threatening yields and global stocks. Expansion in Africa is promising but investors see huge challenges caused by stranded lands and reputational risks.

Expert Perspective & Price Outlook

Palm oil will remain a pillar of global food security, but volatility is here to stay. In line with past CPO price growth (CAGR ~5% over 20 years), IRGA’s tech-led scenario projects CPO prices to reach and sustain a minimum of RM5,500/MT by 2030, with at least 2% annual growth thereafter, as supported by structural global demand and supply constraints. Major analysts and commodity experts echo this positive trend, though caution that climate, labour, and regulatory headwinds will make supply shocks a recurrent threat.

Palm oil is not only a food staple but also a bellwether of food price inflation. Continued investment in sustainable practices, innovation, and technology, paired with attention to rural workforce renewal, will ensure palm oil’s resilience and essential role in feeding a growing world.

About the Author

M R Chandran is the Chairman of IRGA Sdn Bhd and one of Southeast Asia’s most experienced plantation and sustainability leaders, having advised global bodies on the future of palm oil and the broader edible oil sector.

For additional analysis and market insights subscribe to to IRGA AgNews